ಕರ್ನಾಟಕವು ಭಾರತದ ದಕ್ಷಿಣ ಪಶ್ಚಿಮ ಪ್ರದೇಶದಲ್ಲಿರುವ ಒಂದು ರಾಜ್ಯವಾಗಿದೆ. ಇದು ಪ್ರಾಂತ ವಿಂಗಡನೆಯ ಮಸೂದೆಯ ಅಂಗೀಕಾರದ ಮೂಲಕ, 1 ನವೆಂಬರ್ 1956 ರಲ್ಲಿ ರಚನೆಯಾಯಿತು.ಮೂಲತಃ ಮೈಸೂರು ರಾಜ್ಯ ಎಂದು ಕರೆಯಲಾಗುತ್ತಿದ್ದ ರಾಜ್ಯವನ್ನು 1973ರಲ್ಲಿ ಕರ್ನಾಟಕ ಎಂದು ಮರುನಾಮಕರಣ ಮಾಡಲಾಯಿತು ಮತ್ತು ಬೆಂಗಳೂರನ್ನು ರಾಜಧಾನಿಯಾಗಿಸಲಾಯಿತು.

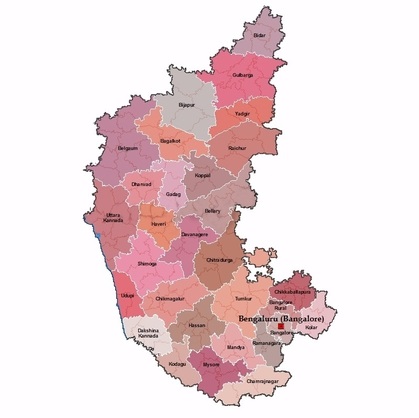

ಕರ್ನಾಟಕದ ಗಡಿಗಳಾಗಿ ವಾಯುವ್ಯದಲ್ಲಿ ಗೋವಾ, ಉತ್ತರದಲ್ಲಿ ಮಹಾರಾಷ್ಟ್ರ, ಈಶಾನ್ಯದಲ್ಲಿ ತೆಲಂಗಾಣ, ಪೂರ್ವದಲ್ಲಿ ಆಂಧ್ರಪ್ರದೇಶ, ಆಗ್ನೇಯದಲ್ಲಿ ತಮಿಳುನಾಡು,ನೈಋತ್ಯದಲ್ಲಿ ಕೇರಳ ಮತ್ತು ಪಶ್ಚಿಮದಲ್ಲಿ ಅರಬ್ಬೀ ಸಮುದ್ರ ಮತ್ತು ಲಕ್ಯಾಡಿವ್ ಸಮುದ್ರಗಳನ್ನು ಹೊಂದಿದೆ. ರಾಜ್ಯವು 191.976 ಚದರ ಕಿಲೋಮೀಟರ್ (74,122 ಚ ಮೈಲಿ) ವಿಸ್ತೀರ್ಣ ಹೊಂದಿದ್ದು, ಭಾರತದ ಒಟ್ಟು ಭೌಗೋಳಿಕ ವಲಯದಲ್ಲಿ 5.83 ರಷ್ಟು ಪ್ರದೇಶವನ್ನು ಆವರಿಸಿದೆ. ಇದು ವಿಸ್ತೀರ್ಣದಲ್ಲಿ ಏಳನೇ ಅತಿ ದೊಡ್ಡ ಭಾರತೀಯ ರಾಜ್ಯವಾಗಿದೆ.

2011 ರ ಜನಗಣತಿಯ ಪ್ರಕಾರ 61.130.704 ಜನಸಂಖ್ಯೆಯನ್ನು ಹೊಂದಿರುವ ಕರ್ನಾಟಕ 30 ಜಿಲ್ಲೆಗಳನ್ನು ಒಳಗೊಂಡು ಜನಸಂಖ್ಯೆಯಲ್ಲಿ ಎಂಟನೇ ದೊಡ್ಡ ರಾಜ್ಯವಾಗಿದೆ. ಭಾರತದ

ಶಾಸ್ತ್ರೀಯ ಭಾಷೆಗಳಲ್ಲಿ ಒಂದಾದ ಕನ್ನಡ ರಾಜ್ಯದ ವ್ಯಾಪಕ ಮತ್ತು ಅಧಿಕೃತ ಭಾಷೆಯಾಗಿದೆ.

ಕೆಐಎಡಿಬಿ

೪ನೇ & ೫ನೇ ಮಹಡಿ, ಈಸ್ಟ್ ವಿಂಗ್,

ಖನಿಜ ಭವನ, ರೇಸ್ ಕೋರ್ಸ್ ರಸ್ತೆ, ಬೆಂಗಳೂರು, ಕರ್ನಾಟಕ-೫೬೦೦೦೧

+೯೧ ೮೦ ೨೨೨೬೫೩೩

+೯೧ ೮೦ ೨೨೨೬೭೯೦೧